29+ proprietary reverse mortgage

Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today. Comparisons Trusted by 45000000.

Pdf Macroeconomic Policies For Poverty Reduction The Case Of Sudan Matias Vernengo Academia Edu

Ad A Guide To Reverse Mortgage Interest Rates.

. Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly. Web A reverse mortgage can be an expensive way to borrow. Web Proprietary reverse mortgages.

Ad 2023s Trusted Reverse Mortgage Reviews. If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works. These are private mortgage loans that are unique to the lender.

Web HECM HECM for purchase jumbo reverse mortgage single-purpose reverse mortgage proprietary reverse mortgages and refinancing loans. Web A proprietary reverse mortgage effectively provides a loan based on equity without regular payments to pay down the remaining balance. This change will save FHA borrowers an.

A loan that lets senior homeowners retrieve the equity in their homes through a private company. Web A proprietary reverse mortgage is one of three types of reverse mortgages that allow you to tap your equity and they can be for more than the Federal Housing. Web These include.

Learn more about how it works. Looking For Reverse Mortgage Rates. A proprietary reverse mortgage is used when a borrowers income is at the other end of the spectrum from those who apply for.

The fees and other costs to borrow money this way can be higher than other alternatives like a home equity loan or. The loan must pay off any. Web Proprietary reverse mortgages are private loans that lack the government insurance of HECMs.

Looking For Reverse Mortgage. Web A proprietary reverse mortgage is a type of loan that gives seniors access to higher amounts of their home equity. Their primary edge for homeowners is they generally offer bigger.

Web Proprietary Reverse Mortgage. These loans are insured by the Federal Housing Administration FHA and are the most common type. They are not as tightly.

Web They typically require down payments between 29 and 63. Search Now On AllinsightsNet. Ad Should You Get A Reverse Mortgage On Your Property.

Web 1 day agoThe HUD is cutting annual mortgage insurance premiums on FHA mortgages from 085 to 055 for most new borrowers. Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today. Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today.

If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works. Web A proprietary reverse mortgage is a loan that allows senior homeowners to access the equity in their homes through a private lender. Home equity conversion mortgage HECMs.

Proprietary Reverse Mortgages Nw Reverse Mortgage

Understanding Proprietary Reverse Mortgages Goodlife

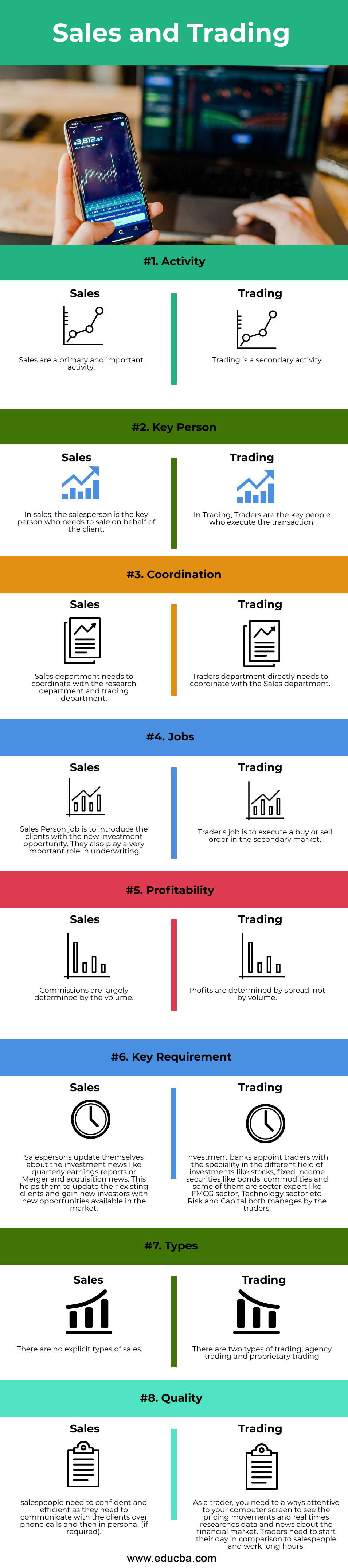

Sales And Trading Top 8 Differences You Should Know

What Is A Proprietary Reverse Mortgage Smartfi Home Loans Llc

Which Is Better A Home Equity Loanor A Reverse Mortgage

What Are Proprietary Reverse Mortgages And Are They Available To New Yorkers

![]()

Reverse Mortgage Requirements Hecm Single Purpose Jumbo Loans Moneygeek Com

:max_bytes(150000):strip_icc()/GettyImages-186479133-5c17c908c9e77c0001fd19ee.jpg)

Proprietary Mortgages Vs Home Equity Conversion Mortgages

Sales And Trading Top 8 Differences You Should Know

Atlanta Reverse Mortgages Top Reverse Mortgage Lender In Atlanta

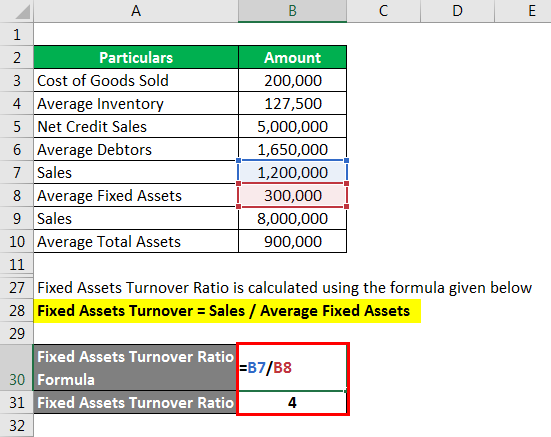

Accounting Ratios Example Explanation With Excel Template

The Best Reverse Mortgage Lenders Of 2023 Caring Com

What Is A Proprietary Reverse Mortgage Understanding Reverse

Article Of Association Objectives And Contents Of Article Of Association

Proprietary Jumbo And Other Reverse Mortgage Options

What Is A Reverse Mortgage Requirements Pros And Cons Intuit Mint

Types Of Reverse Mortgages Hecm And Proprietary